Inside a ₹3 L P&L: stress-testing a micro-cap equities strategy

5/17/2025

Scope: This is about risk anatomy, not secret sauce. Entry logic stays private; the focus is on how I audit any strategy before scaling.

1 · Top-line scorecard

| Metric | Value |

|---|---|

| Total realised P&L | ₹ 3.4 L |

| Daily Sharpe Ratio | 2.3 |

| Daily Sortino | 3.9 |

| Max draw-down | ₹ -1.25 L (-48 %) |

| Win-rate | 51 % |

| Average win / loss | ₹ 64 / ₹ 58 |

| Kelly fraction | ≈ 7 % of bankroll per position |

| Mean / median holding | 32 d / 8 d |

Interpretation:

- Sharpe > 2 while draw-down < 50 % keeps the sleep-at-night factor acceptable.

- Pay-off skew matters more than win-rate—coin-flip hit-rate is fine when losses are capped.

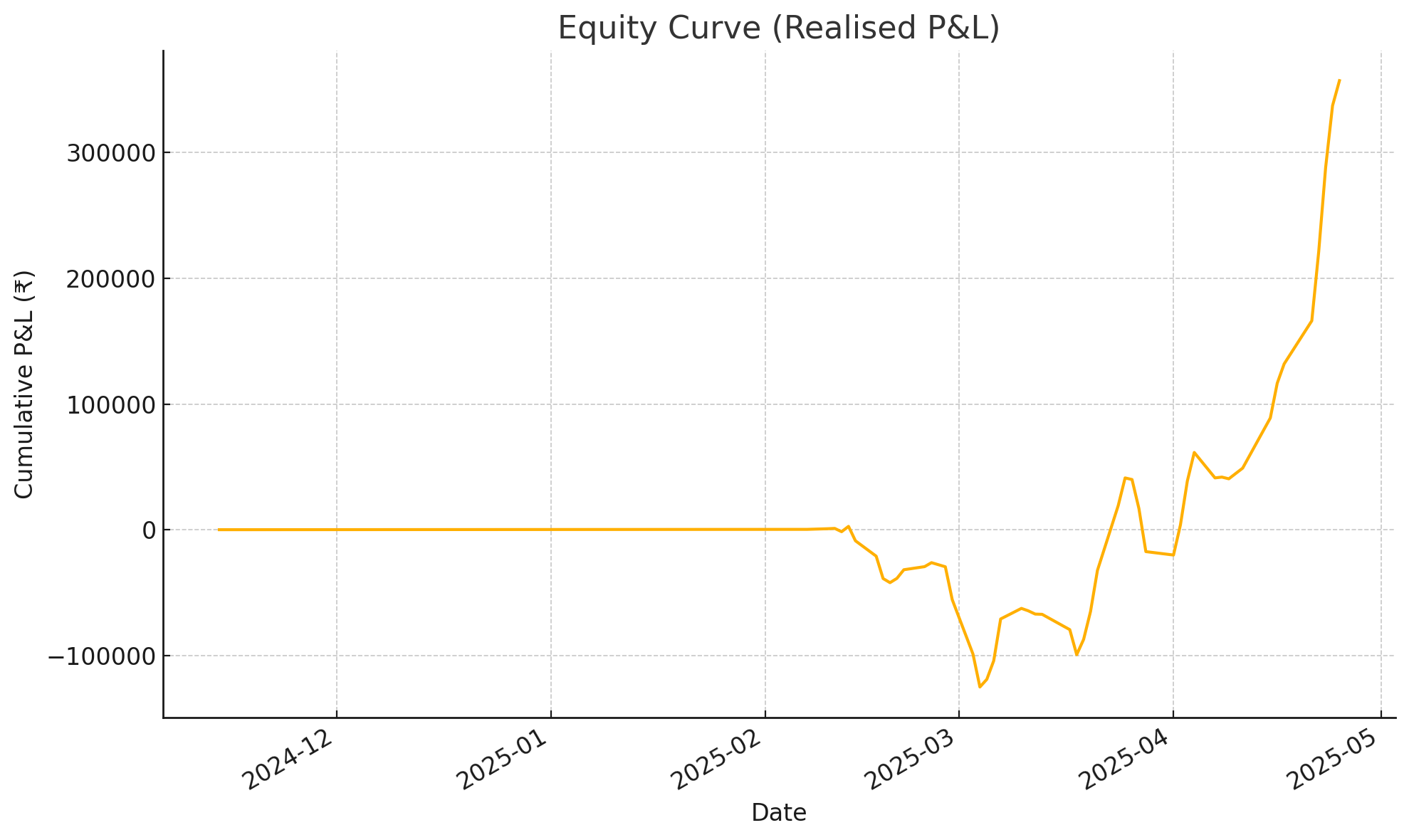

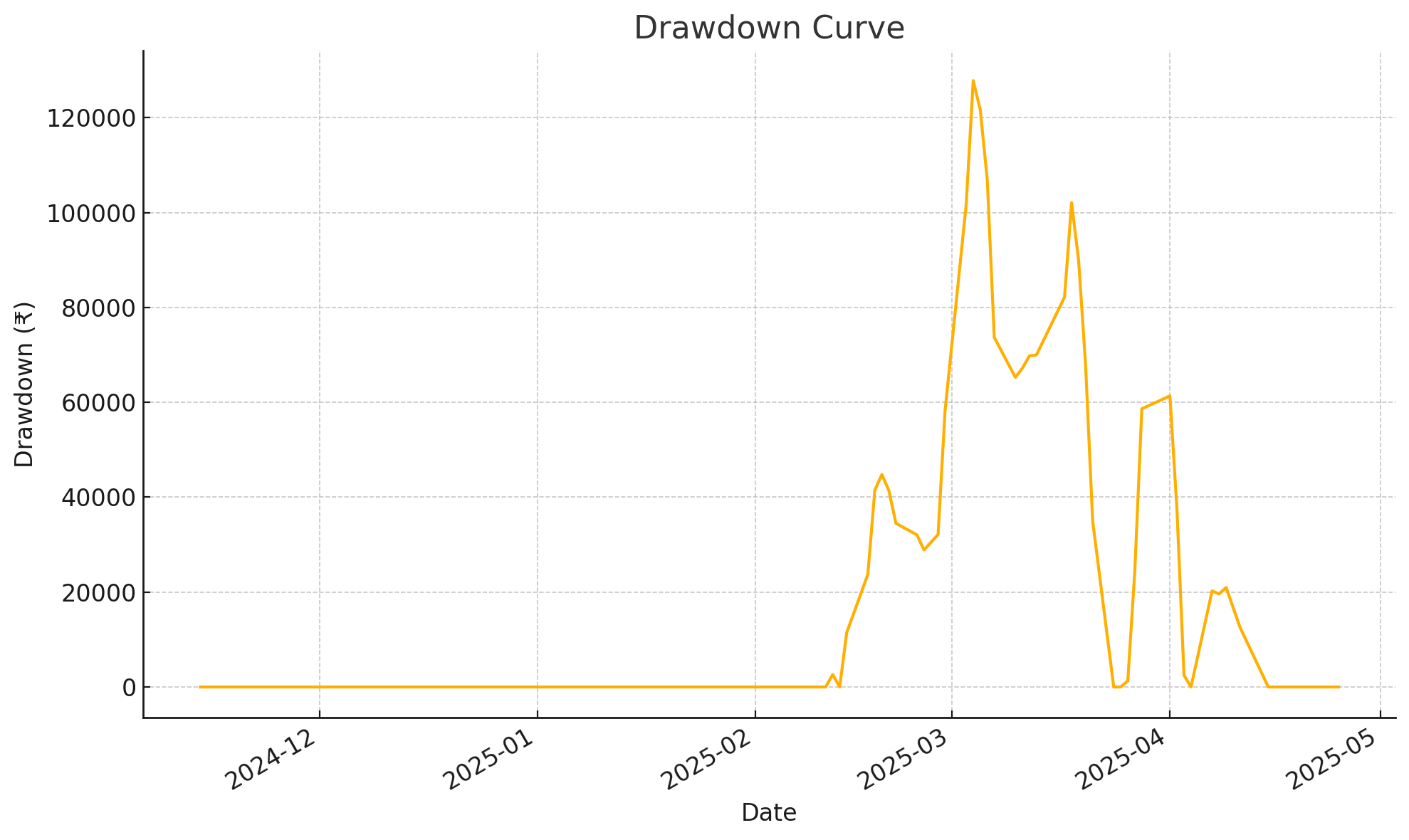

2 · Equity & pain

Left: cumulative realised P&L.

Right: draw-down stays < ₹1.3 L; time-to-recover < 25 calendar days.

3 · Trade micro-structure

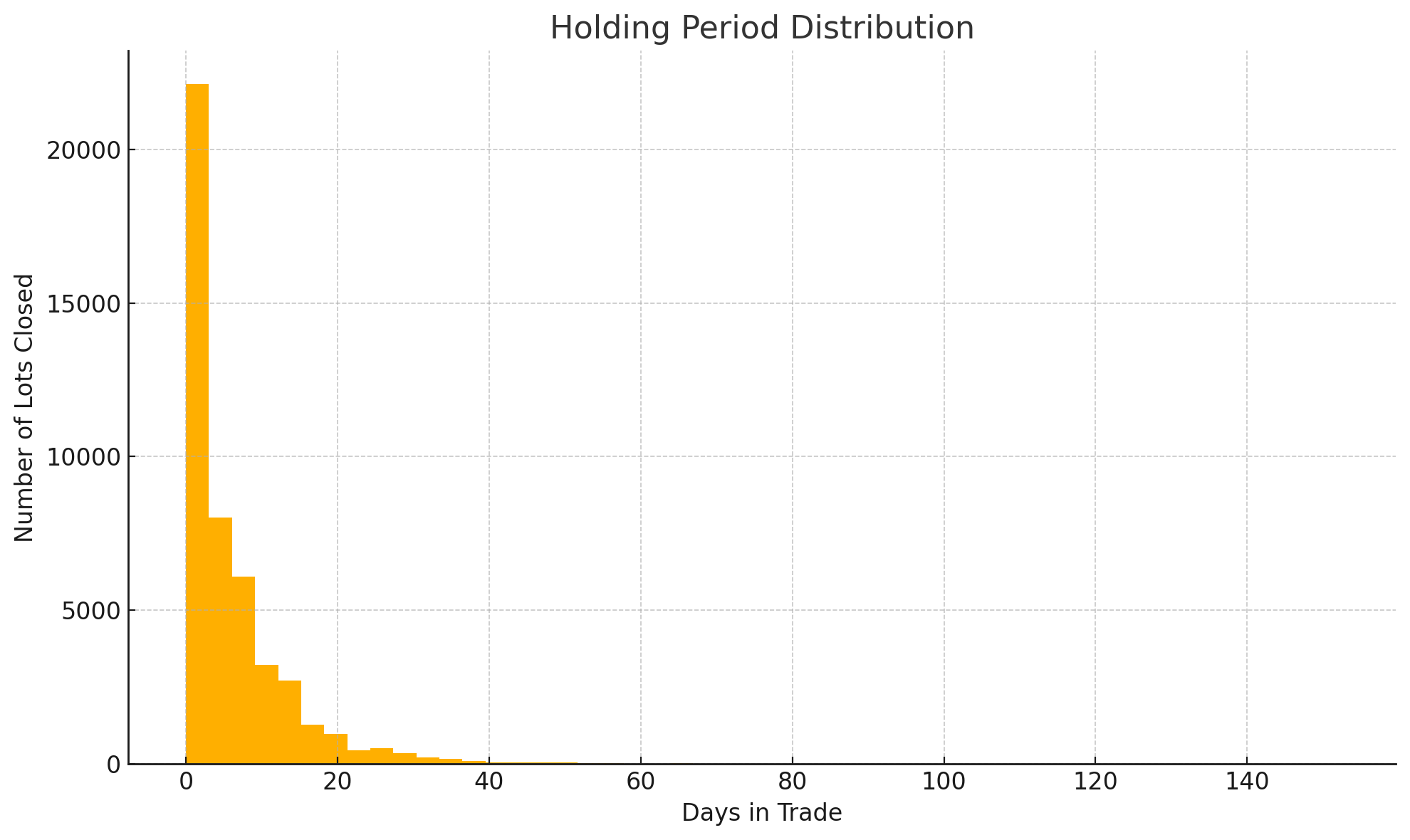

Holding-time distribution

73 % of lots close inside five trading days; the tail is inventory that drifts until spreads mean-revert.

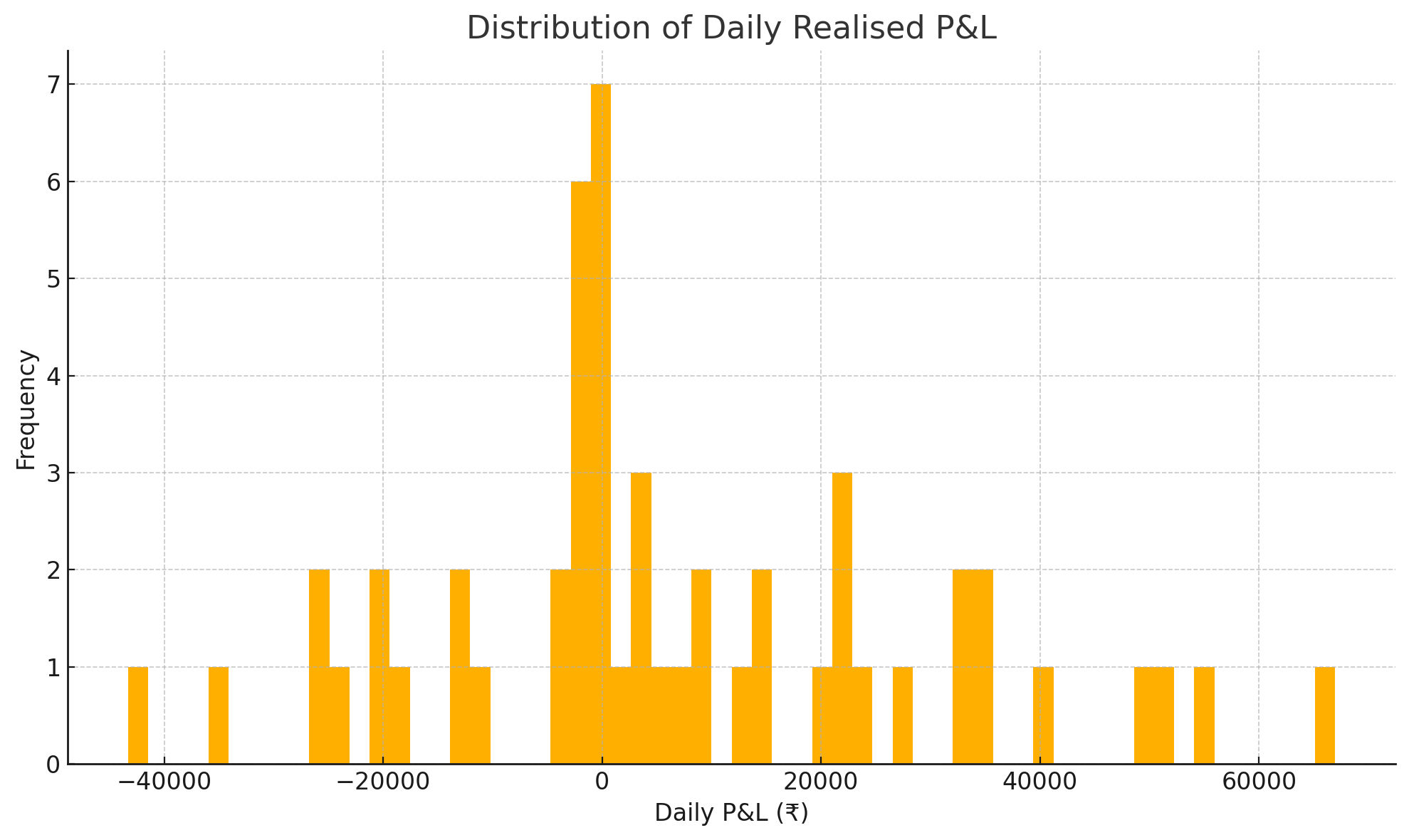

Daily P&L dispersion

- Majority of days ± ₹5 k.

- 90-th percentile winners offset the occasional -₹40 k tail.

Day-of-week edge

| Weekday | Trades | Net P&L | Avg ₹/trade |

|---|---|---|---|

| Monday | 5 % | -ve | -₹ — |

| Tuesday | 21 % | +ve | +₹ — |

| Wednesday | 22 % | flat | +₹ — |

| Thursday | 28 % | +ve | +₹ — |

| Friday | 24 % | flat | +₹ — |

(Exact rupees redacted—pattern is what matters.)

4 · Position-sizing sanity check

The simplified Kelly calc ⇒ 7 % of capital per independent bet.

I cap at 2-3 % to stay below volatility-induced margin calls; Kelly is an upper bound, not a dare.

5 · Next optimisation avenues

| Idea | Rationale |

|---|---|

| Skip Mondays | Historical bleed—Sharpe improves in sim. |

| Time-stop losers at T+2 | 50 % of negative trades rot after day 2. |

| Fee audit | Brokerage / STT shave Sharpe by ≈ 0.2—small but measurable. |

| Dynamic size on draw-down | Half-Kelly when equity < peak-10 % smooths curve without killing CAGR. |

Wrap-up

Edge without risk discipline is roulette.

Run your strategy through the same gauntlet—if your equity curve can’t live through a mark-to-market -40 %, size down or iterate until it can.